Struggling For Growth Capital? 50+ Alternative Financing Examples Beyond Traditional VC

Traditional venture capital isn't the only game in town: not even close. While VCs dominate the headlines, smart companies are increasingly turning to alternative financing sources that offer more flexibility, better terms, and faster access to capital. Whether you're a bootstrapped startup or an established mid-market company, the financing landscape has evolved dramatically over the past decade.

The numbers tell the story: private credit markets have exploded past $1.7 trillion globally, secondary markets are projected to exceed $210 billion in 2025, and companies are staying private longer while accessing larger funding rounds than ever before. This shift has created opportunities that didn't exist even five years ago.

Let's dive into the comprehensive menu of financing alternatives that could be exactly what your business needs.

Private Debt and Credit Solutions

Direct Lending and Corporate Credit

Private credit has emerged as one of the most significant alternatives to traditional equity financing. Unlike venture capital, these solutions don't dilute your ownership: they provide debt capital with predictable repayment terms.

Direct lending from private credit funds

Corporate direct lending for established businesses

Senior secured credit with asset backing

Unitranche financing combining senior and mezzanine debt

Asset-based lending secured by inventory, receivables, or equipment

Revenue-based financing tied to monthly revenue streams

Equipment financing for specific asset purchases

Invoice factoring for immediate cash flow

Supply chain financing for working capital needs

Bridge loans for short-term capital gaps

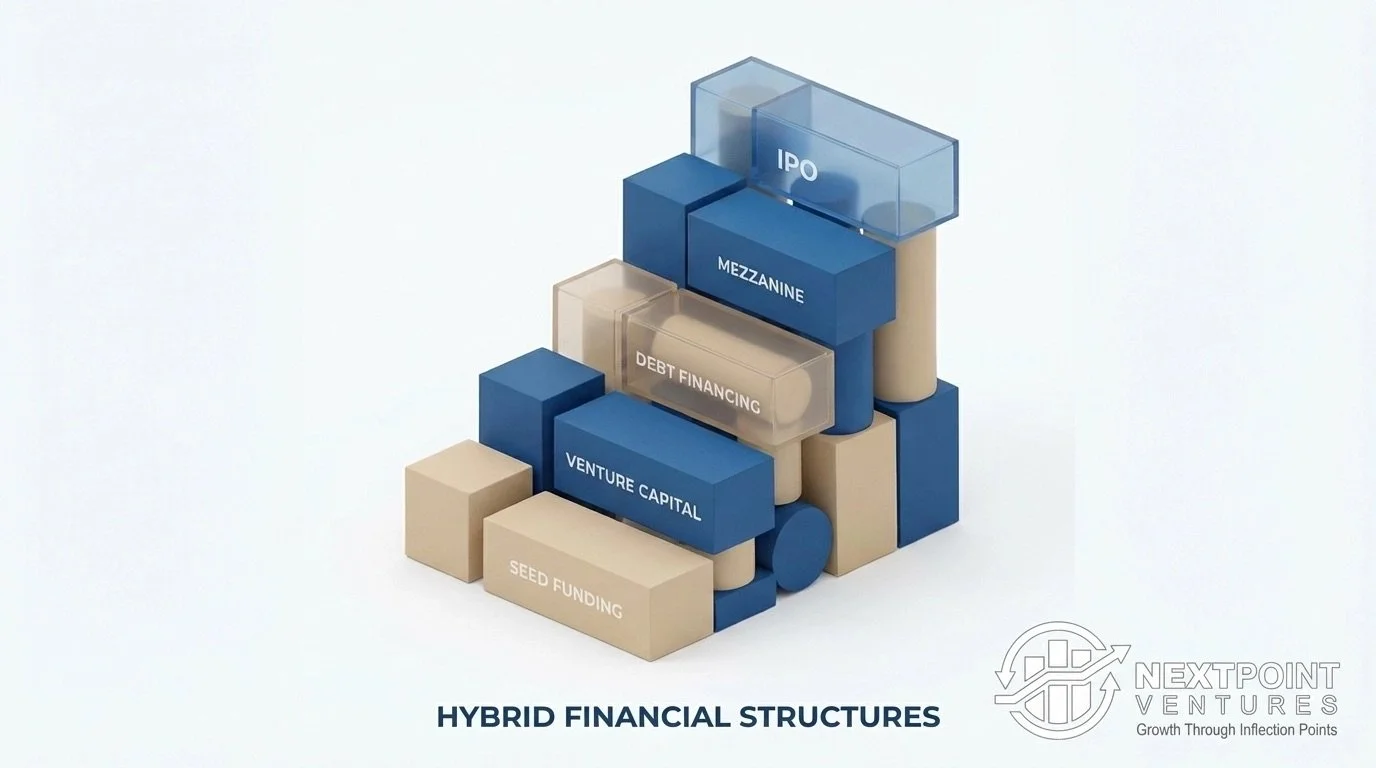

Mezzanine and Hybrid Solutions

These financing types sit between debt and equity, offering more flexible terms than traditional bank loans while avoiding the high dilution of equity rounds.

Mezzanine financing with equity kickers

Convertible debt with future equity conversion options

Preferred equity structures

PIK (Payment-in-Kind) notes

Subordinated debt with higher yields

Alternative Equity Structures

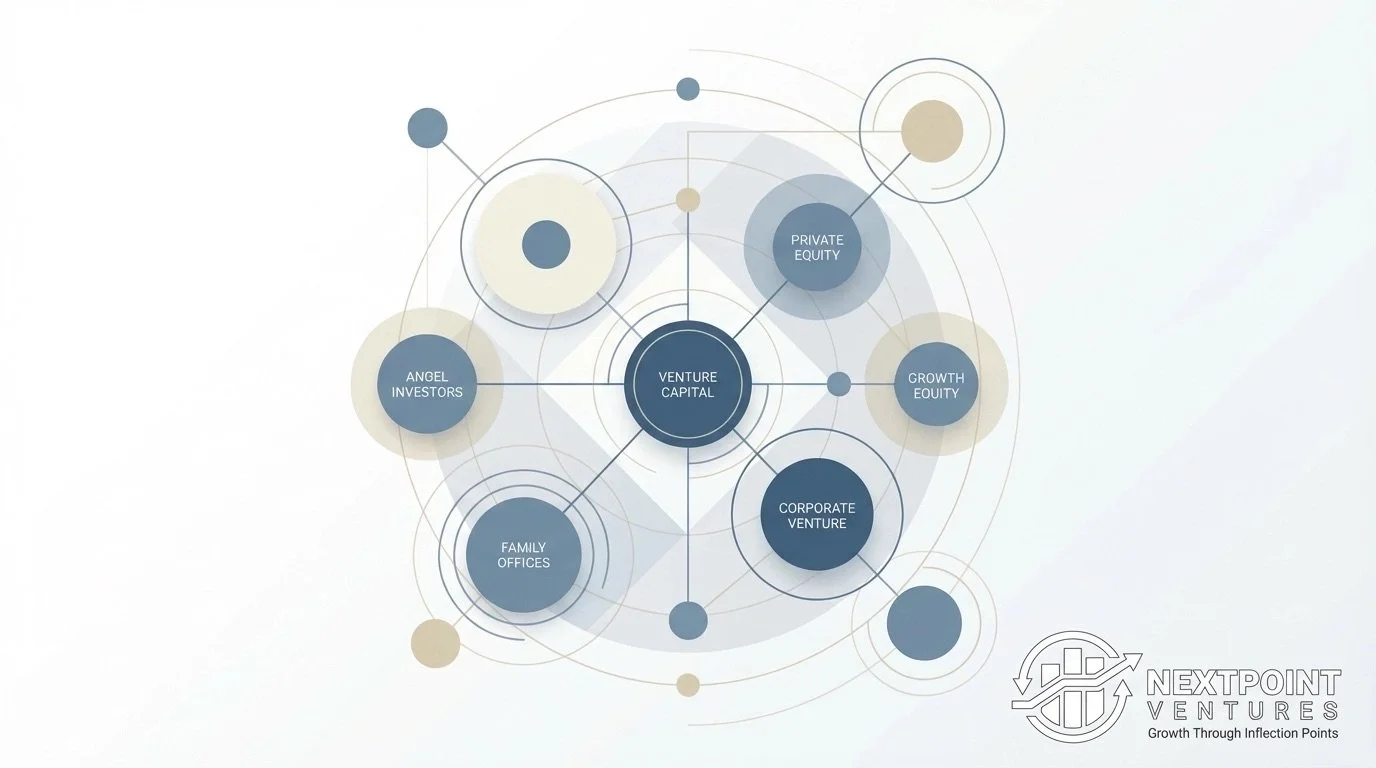

Growth Capital Beyond VC

Growth equity has become increasingly relevant as companies scale beyond the typical VC sweet spot. These investors focus on established businesses with proven revenue streams and clear paths to profitability.

Growth equity from specialized funds

Private equity buyouts for established companies

Family office investments with patient capital

Strategic corporate investments from industry players

Sovereign wealth funds for larger deals

Secondary market transactions for existing shareholders

Employee stock ownership plans (ESOPs)

Management buyouts (MBOs)

Leveraged recapitalizations

Real Estate and Asset-Backed Options

For businesses with significant real estate components or asset-heavy models, these financing sources can provide substantial capital while leveraging existing assets.

Commercial real estate loans

Sale-leaseback transactions on owned properties

Real estate investment trusts (REITs) partnerships

Hard money loans for quick real estate acquisition

Construction-to-perm financing

Ground lease arrangements

Real estate crowdfunding platforms

Alternative Platforms and Marketplaces

The democratization of capital markets has created numerous platforms that connect businesses directly with investors, bypassing traditional intermediaries.

Peer-to-peer lending platforms

Online marketplace lending

Equity crowdfunding platforms

Initial coin offerings (ICOs) and token sales

Security token offerings (STOs)

Real estate crowdfunding platforms

Art and collectibles financing

Commodity financing arrangements

Government and Institutional Sources

Often overlooked, government programs and institutional sources can provide significant capital at attractive terms, especially for businesses in specific industries or geographic areas.

SBA loans and government-backed financing

State and local economic development programs

Export-Import Bank financing for international trade

USDA rural development programs

Small business investment company (SBIC) funding

New Markets Tax Credit projects

Opportunity Zone investments

R&D tax credits and grants

Industry-specific grants and incentives

Specialized Industry Solutions

Certain industries have developed their own unique financing ecosystems that can provide capital in ways that traditional sources cannot.

Healthcare receivables financing

Pharmaceutical royalty investments

Entertainment and media financing

Energy project financing

Agriculture and commodity financing

Technology licensing arrangements

Intellectual property monetization

Strategic Considerations for Alternative Financing

Timing and Market Conditions

The current market environment heavily favors alternative financing sources. With traditional VC becoming more selective and valuations under pressure, many companies find better terms and more flexible structures through alternative channels.

Private credit offers predictable costs and timeline certainty that equity rounds simply can't match. When you need to close financing in 30-60 days rather than 6-9 months, debt solutions often provide the speed and reliability that growing businesses require.

Cost of Capital Analysis

While alternative financing might appear more expensive than traditional equity on the surface, the true cost calculation is more nuanced. Consider the dilution factor: giving up 20% equity in a traditional VC round could cost significantly more than paying 10-15% interest on debt capital, especially if your business is growing rapidly.

Operational Flexibility

Many alternative financing sources provide more operational flexibility than traditional VC. Revenue-based financing scales with your business performance, asset-based lending grows with your asset base, and debt financing doesn't come with board seats or operational restrictions that can slow decision-making.

The Next Point Ventures Approach

At Next Point Ventures, we've seen firsthand how the right alternative financing can accelerate growth while preserving founder control and equity value. Our Solution Stack approach often incorporates multiple financing sources to create optimal capital structures for our portfolio companies.

The key is matching the financing source to your specific business model, growth stage, and strategic objectives. A SaaS company with predictable recurring revenue might benefit from revenue-based financing, while a manufacturing business might find asset-based lending or equipment financing more appropriate.

Making the Right Choice

The explosion of alternative financing options means that virtually every business can find capital sources that align with their specific needs and growth trajectory. The challenge isn't finding capital: it's selecting the right combination of sources that optimize for cost, flexibility, and strategic alignment.

Success in today's financing landscape requires understanding these alternatives, evaluating them against your specific situation, and often combining multiple sources to create the optimal capital structure. The companies that master this approach will have significant advantages over those that rely solely on traditional venture capital.

The financing world has evolved beyond recognition from just a decade ago. Smart entrepreneurs and business owners are taking advantage of this evolution to fuel growth on their own terms, with better economics and more control than traditional financing ever offered.

Ready to explore which alternative financing sources align with your growth objectives? The landscape is rich with opportunities: you just need to know where to look and how to evaluate them against your specific business needs.